Membership-based loan platform

Improving the code quality and security of a loan administration system.

Client

Creditspring

Industry

Finance

Services

Web app development, DevOps, R&D

Timeline

2018 - 2021

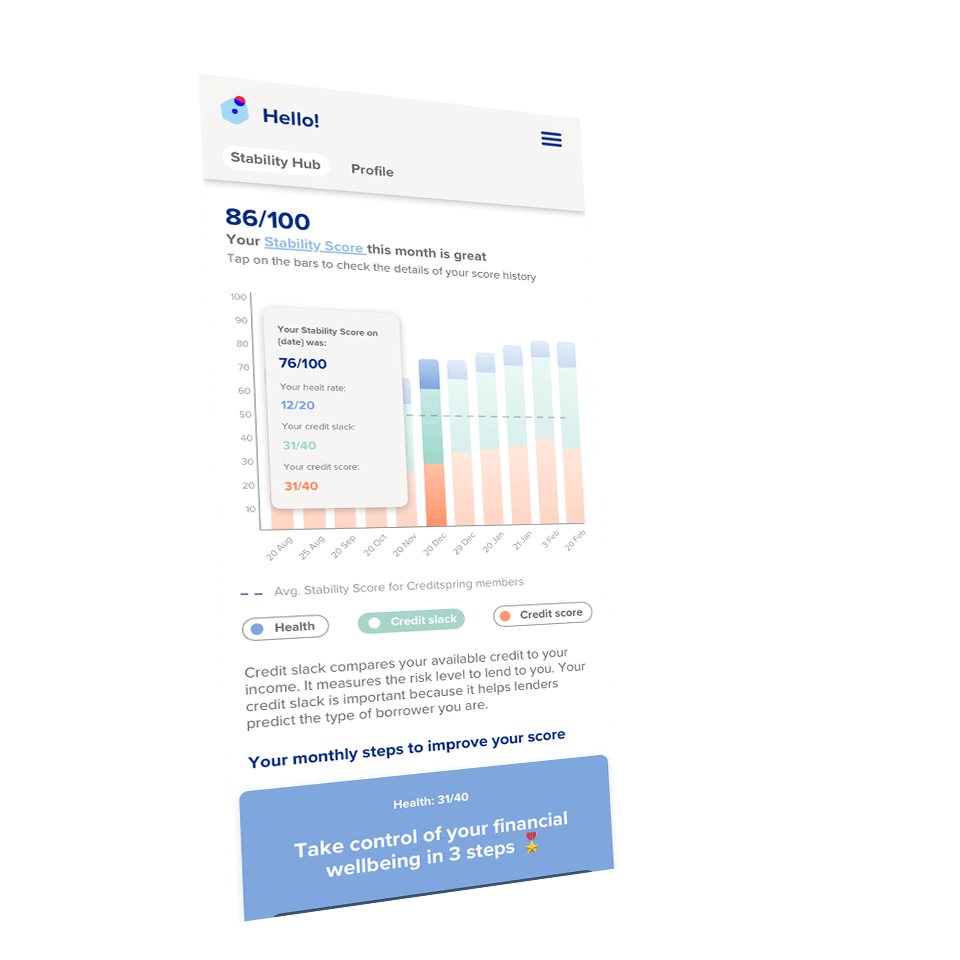

About Creditspring project

Creditspring brings a new personal finance model to the market. Through a monthly membership fee, users gain access to a certain number of guaranteed, lighting-fast, on-demand loans each year. The lending process is fully transparent with no hidden costs.

Delivered solution

iRonin.IT’s experts worked on many elements of the Creditspring app, improving the main tool used by the client’s team, creating new functionalities based on current needs (e.g. for loan restructuring), and building a slicker, more user-friendly interface.

Goals and results

R&D and Proof of Concept development

We based our approach on thorough research and vast experience and built a proof of concept which was approved by Creditspring's CTO and responded to the specific needs of the client.

Fixing a central feature and improving UX

The admin panel had to be more coherent, with better filtering and sorting options. The goal was to improve the app’s UX and efficiency. We used daily standups to keep everyone up-to-date.

Establishing and enabling QA processes

For this project, we adjusted our QA testing processes: i.e., to learn what would happen to users who hadn’t paid off their loans in time, we shifted the app’s timeline a few months forward.

Technologies

A modern and reliable stack for web app development

Development of user-friendly UI, powerful analytics and R&D solutions based on a well-rounded and stable stack.

Ruby

Rails

PostgreSQL

Sidekiq

Redis

Stimulus.js

Heroku

RSpec

Equifax

Zendesk

Mixpanel

Results

A refined administration panel

Our work on the administration panel involved UI improvements and new features. Integration with Zendesk enabled effective presentation of important data on the admin panel, including customer complaints and requests for account cancellation.

Time travel testing

By shifting Creditspring’s timeline in the app’s Quality Assurance process, we were able to test for issues that might occur months ahead in the customer journey, such as the consequences of unpaid loans for users who have been registered for some time.

Custom configuration for data logging

As the entire app was hosted on Heroku, the client’s Datadog system needed to be too. To this end, we added support for custom configuration for Datadog to Heroku’s official buildpack, and built a custom integration for Creditspring.

We hired iRonin.IT with the goal of augmenting our in-house development team to build new functionalities for our front office and back office systems. iRonin.IT's skilled team of developers were crucial to the success of the project. Their collaborative approach supplemented their professional management style. Their attention to detail was also noteworthy.

Alfredo Motta

CTO @ Creditspring

Let’s kickstart your project. Contact us today.

Contact usRead more

Consumer lending platform development

Ruby

Sidekiq Enterprise

JavaScript

AWS